Medicare Supplemental Insurance

Medicare Supplemental Insurance helps reduce or eliminate out-of-pocket medical costs.

These cost-effective plans work alongside your Original Medicare coverage to protect both your health and bank account.

Want Help Shopping For Your Plan?

Fill out the form on your screen to get started today. One of our independent agents will help you shop and compare all your Medicare Supplement options to find your best policy and price.

Our services are free. And there’s never any obligation when speaking with an agent.

What is Medicare Supplemental Insurance?

Although Original Medicare provides excellent health care coverage, it’s far from comprehensive. Looming within Medicare are copayments, coinsurance, and multiple deductibles, which leave you exposed to high out-of-pocket medical costs. Medicare supplemental insurance policies, also known as Medigap, fill these finical gaps to keep money in your pocket.

Medicare Supplements are private insurance policies that work alongside your existing Medicare benefits and protect your bank account.

How Do Medigap Policies Work?

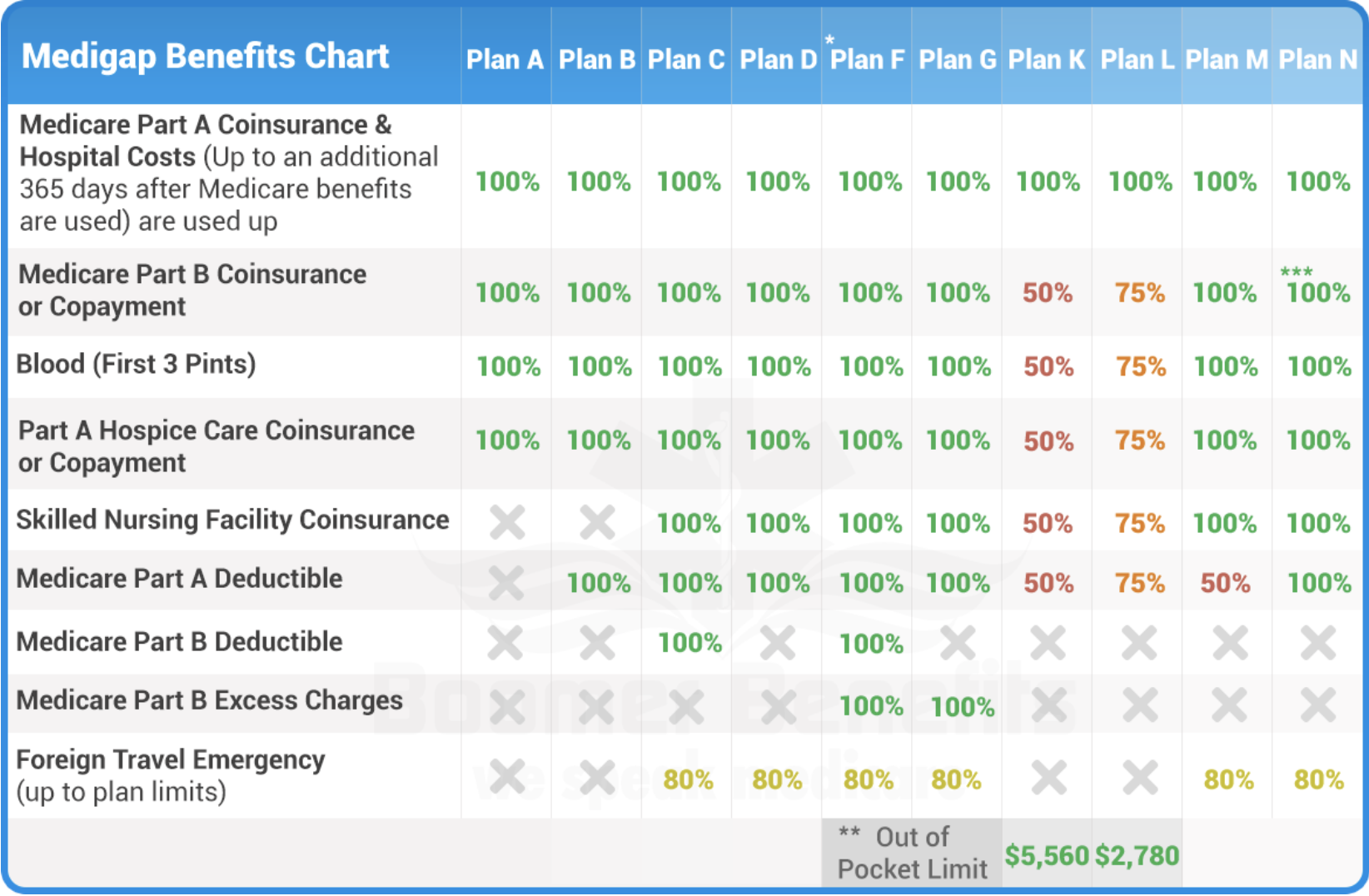

There are ten different Medigap insurance plans lettered A – N. Each plan covers a different set of gaps in your standard Medicare coverage.

Medicare “standardizes” all lettered plans to provide the same benefits no matter which company you purchase from. We’ve provided links so you can explore each plan individually or see how they compare side by side in the chart below.

Personalized Medigap Insurance Quotes

Receiving Your Benefits

When you need medical care, Medicare provides your primary health insurance coverage. They always pay first. Medicare Supplement Insurance is a secondary form of coverage that kicks in to fill the financial gaps not covered by Original Medicare.

These two layers of coverage work together to provide better coverage and lower out-of-pocket costs.

The Difference Between Medigap & Medicare Advantage

It’s important to understand that Medigap policies only provide financial protection by reducing or eliminating copays, coinsurance, and deductibles for your Medicare-covered services. Medicare supplements do not add any additional benefits or covered services.

On the other hand, Medicare Advantage does expand your Medicare benefits to include vision, hearing, dental, and prescription drug coverage. These plans are more expensive but provide more comprehensive health care coverage

Our independent agents can help you explore Medigap and Medicare Advantage Plans to help you find what fits you best.

The Popularity of Medigap Policies

You might find it surprising that 8 out of 10 Medicare Beneficiaries (81%) own some form of supplemental insurance. It goes to show that although Original Medicare is great, most people need additional protection.

Individuals who do not own a Medicare Supplement plan are exposed to paying out-of-pocket medical costs every time they use their Medicare benefits.

What Are the Most Popular Medicare Supplemental Insurance Plans?

Although there are ten Medigap options, Plan F, G, and N are by far the most popular options because they provide the most value and the most financial protection. Here’s a brief overview of the most popular Medigap policies.

Plan F

Plan F is the most comprehensive Medicare Supplement plan and has been for many years. This plan covers all copays, coinsurance, and deductibles to ensure that you never pay out-of-pocket for any Medicare-covered service. Unfortunately, however, Plan F is no longer available to individuals new to Medicare. Only individuals who qualified for Medicare benefits before January 1, 2020, have access to this plan. Medicare decided to no longer offer plans that cover the annual Part B deductible (Plan F & Plan C).

Plan G

Medicare Plan G is the second most popular Medicare Supplement plan behind plan F. This plan provides big savings and protection for all out-of-pocket Medicare costs except for the annual Part B deductible. This is the most comprehensive option available to new Medicare beneficiaries.

Plan N

Plan N is the third most popular Medigap option and offers the right balance of affordable premiums and out-of-pocket costs. If you purchase this plan, you’ll pay the Part B deductible, any excess charges, and copays for certain services. Medigap Plan N is attractive to those who want a small annual deductible and reduced copays for office visits.

Where to Buy Medicare Supplement Insurance Policies

Although the government regulates Medicare Supplements, private insurance companies sell them directly to the consumer. Therefore, you have the option of choosing the carrier you buy from. Consumers can go directly to each carrier to explore their options or work with an independent agency to shop and compare all the top carriers side by side.

There are dozens of insurance providers offering Medigap policies. However, some are better than others. Here’s our list of the top Medicare Supplement Companies for 2021

- Transamerica Medicare Supplement Plans

- Mutual of Omaha Medicare Supplement Plans

- Aetna Medicare Supplement Plans

- Blue Cross Blue Shield Medicare Supplement Plans

- AARP Medicare Supplement Plans

We strongly suggest exploring these carriers before moving forward with a policy purchase.

Get Help Finding Your Best Policy

Shopping for health insurance alone is a tedious and time-consuming process. Savvy shoppers who choose to work with an independent agency such as ours will save both time and money on their plan.

We help you navigate your many options to find your best policy and lowest premium price quickly and without the hassle.

As mentioned above, our services are free. And there’s never any obligation.

Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.