Medicare Advantage

Medicare Advantage provides an all-in-one solution to your health care needs.

These private insurance plans allow you to customize your Medicare benefits to provide comprehensive health insurance coverage.

What is Medicare Advantage?

Though Original Medicare provides excellent health insurance coverage, it’s far from perfect. Also known as Medicare Part C, Medicare Advantage Plans are private health insurance policies that allow you to customize and expand your Original Medicare benefits to include vision, dental, hearing, and prescription drug coverage. They also help fill the financial gaps looming within Medicare which protects you from high out-of-pocket medical expenses.

Every year, millions of Americans enroll in Medicare Advantage to protect their health and their finances. Our team of Medicare experts is here to help you shop and compare all of your available options. Simply fill out the form on your screen to get started.

Does Medicare Advantage Effect My Original Medicare Benefits?

When you purchase Medicare Advantage you still keep all of your Original Medicare benefits. These ‘bundled’ plans combine Medicare Part A, Part B, and Part D, into one single plan and add additional benefits to fill in the services not covered. You keep all your Original Medicare benefits while also expanding and enhancing your health insurance coverage.

Medicare Advantage Continues to Gain Popularity

In 2020, 24.1 million people (39%) enrolled in Medicare Advantage. This rate has steadily increased every year since the early 2000’s; and the Congressional Budget Office projects that by 2030 over 50% of all Medicare beneficiaries will own a Medicare Part C policy.

Difference Between Medicare Advantage and Medigap

Within your Original Medicare benefits are co-pays, coinsurance, and multiple deductibles, which leave you exposed to high out-of-pocket medical expenses. Medicare Supplemental Insurance (Medigap) fill these financial gaps to reduce or eliminate out-of-pocket medical costs. Medigap does not add any additional benefits.

Advantage Plans also fill the financial gaps looming within Medicare and they also add additional benefits and covered services such as dental, vision, hearing, and prescription drugs.

Personalized Medicare Advantage Quotes

How You Receive Your Care

The private insurance companies who sell these policies administer your care through a local network of doctors. During enrollment you’ll have the choice between two types of Medicare Advantage networks, HMO or PPO.

Medicare Advantage HMO (health maintenance organization) is a network of doctors that facilitate all the benefits with your Medicare Advantage policy. Coverage does not extend outside your network. In other words, you can only receive services from providers within the HMO network. HMO’s are much more popular than PPO’s and there are about 10x as many plan options.

Medicare Advantage PPO (preferred provider organization) on the other hand allow you to see any doctor that takes Medicare patients even if they are not in your ‘preferred’ network. These plans offer lower-cost services if you elect to receive services from a ‘preferred provider’ because it helps reduce waste and overhead expenses for the company.

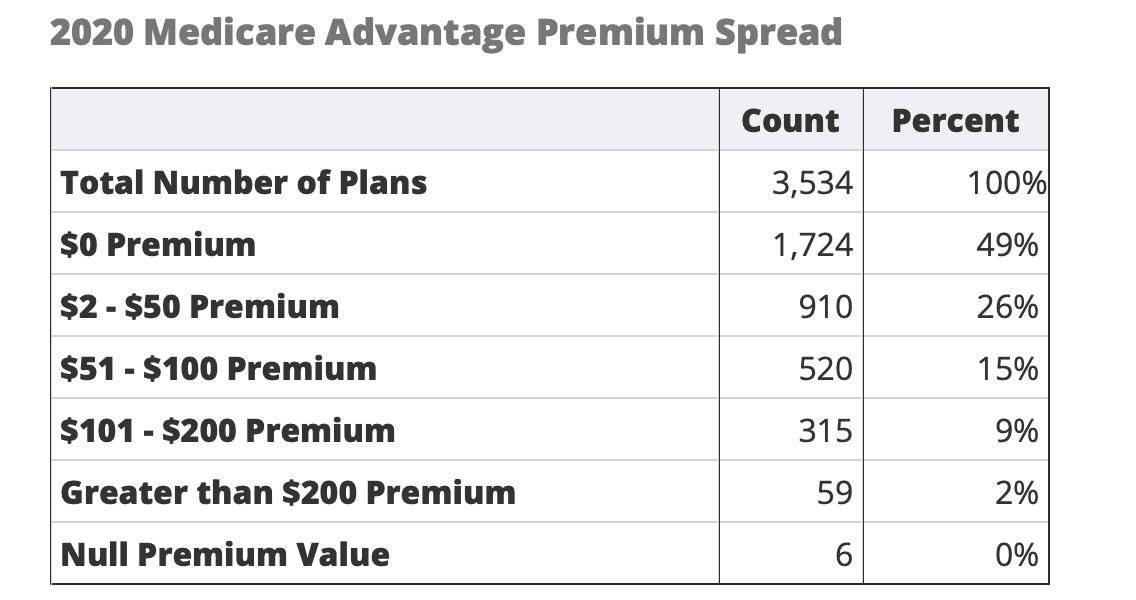

How Much Do Medicare Advantage Plans Cost?

Though strictly regulated by Medicare, the private insurance companies who sell Advantage plans set their policy rates. This means that the only way to find out the cost of Medicare Advantage is to shop and compare quotes from different providers.

Pay for what you get

The benefits included in your policy affect the cost of your monthly premium. Most insurance companies allow you to choose which benefits you want and leave out the ones that you don’t. This highlights the importance of working with an insurance agent because they help you customize your policy so that you only pay for the services you need.

Medicare Helps Pay for You Policy

Medicare mandates that all Advantage policies include your Original Medicare benefits. Therefore, each month Medicare sends a check to the issuing insurance company to pay for your Original Medicare benefits that get bundled inside your Medicare Advantage Plan. As a result, you only pay for the additional benefits you choose that are not included in Original Medicare, making these policies relatively affordable for most households.

When To Enroll

You can enroll in Medicare Advantage during either your initial Medicare Enrollment Period or the annual enrollment period each year.

Your initial Medicare enrollment period is a seven-month window that starts three months before your 65th birthday, includes your birthday month, and extends the following three months. It’s important that you sign up for your Original Medicare benefits during this time to avoid paying a financial penalty.

If you choose not to purchase Medicare Advantage during your initial enrollment period you can also sign up during the annual enrollment period that takes place each year between October 15th and December 7th.

All individuals eligible for Medicare are automatically eligible for Medicare Advantage.

Shop and Compare Before You Buy

It’s important to remember that private insurance companies Medicare Advantage policies; and that these private companies operate within state lines and set their own premium rates. Therefore, finding your best policy will depend on your state of residence and which carrier options you have available.

Savvy shoppers will take the time to shop and compare Medicare Advantage Plans before purchasing. Doing so can ensure that you get the most policy value and the lowest premium cost.

Our independent insurance agency is here to help you do just that. We help you shop and compare all the top insurance providers operating in your state to ensure you don’t overpay for your coverage. We’re here to answer all of your questions and to provide support and assistance for all things Medicare.

Our agents work for YOU, not the insurance companies. Our services are free. And there’s never any obligation when working with an agent.

We’ve helped thousands of individuals find better coverage and lower rates. We’d love to help you too!

Explore your options today. Get started with free quotes by filling out the form on your screen.

Get Free Medicare Help

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.