Medicare Supplement Plan A

Medicare Supplement Plan A is the most basic of all Medigap policies.

Although simple, this plan can go a long way in protecting your bank account.

Below we take a quick look at what Medigap Plan A has to offer.

Quick Overview Of Medicare Supplements

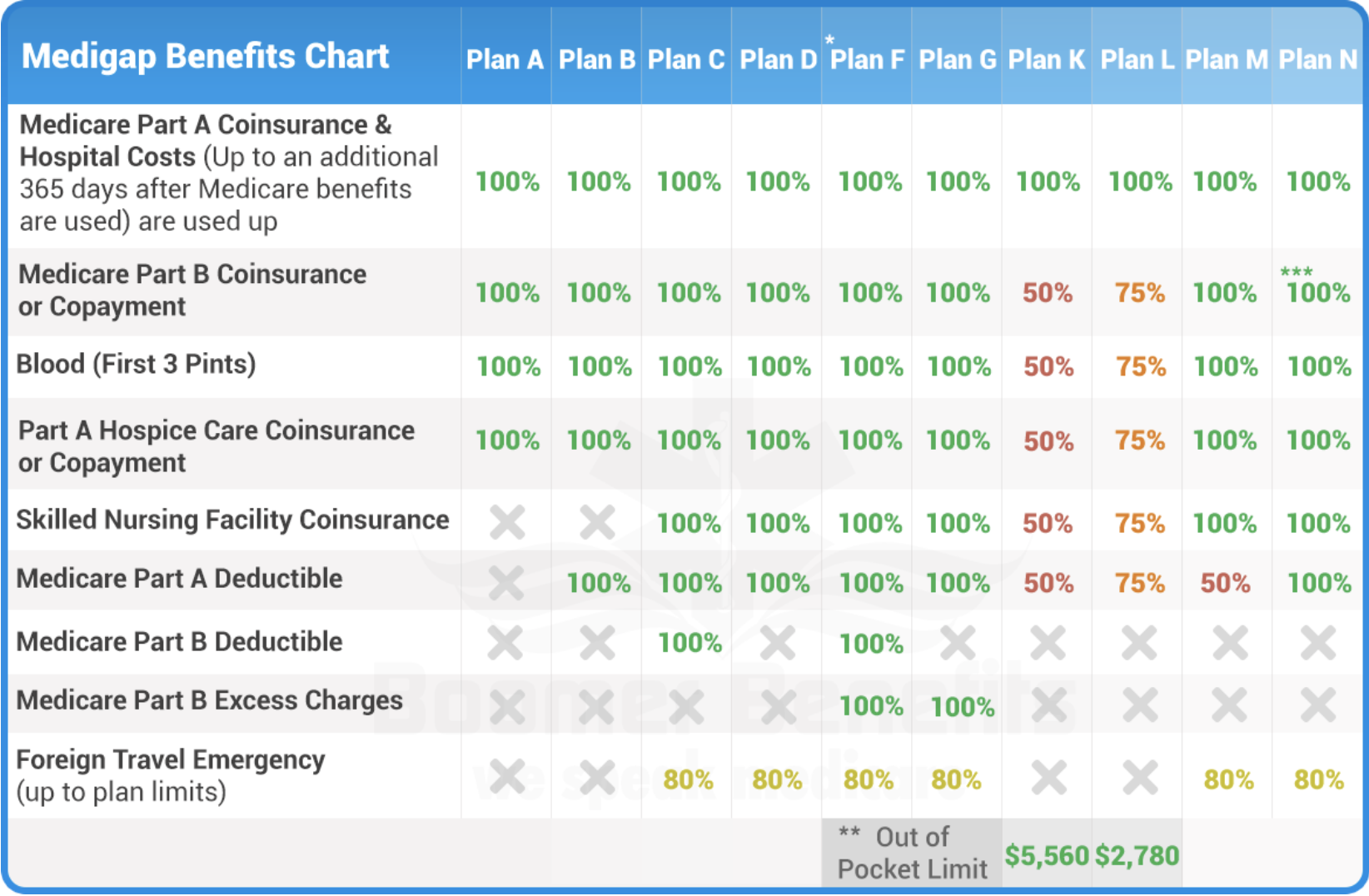

There are 10 Medicare Supplement Plans (Medigap) lettered A-N. Each plan covers a different set of financial gaps within your Medicare Coverage. These plans reduce or eliminate out-of-pocket Medicare costs that come in copays, coinsurance, and multiple deductibles.

Medigap policies are affordable and a popular choice among most Medicare Beneficiaries. Today, 8 out of 10 recipients have some form of supplemental coverage.

What Does Medicare Supplement Plan A Cover?

This simple plan covers the two biggest financial gaps within Medicare.

- Medicare Part A coinsurance up to 365 days – this benefit expands your inpatient medical care from 100 days to a full year and covers the daily coinsurance cost of inpatient hospital stays. If you were to need an extended stay in a hospital or treatment center, this would save you tens of thousands in out-of-pocket costs.

- Medicare Part B coinsurance on all inpatient medical care services – without a supplement policy, you’ll pay a 20% coinsurance on all your outpatient medical care. That includes all office visits, testing, specialist, and any service that you are not admitted into a hospital for. That 20% can add up quickly, and there is no out-of-pocket maximum. Medigap plan A covers this gap in full.

Additionally, Medicare supplemental plan A also covers:

- The first three pints of blood used in any medical procedure or surgery

&

- Medicare Part A hospice care coinsurance expense or copayment – if you need hospice care, this benefit could save you thousands.

Medigap Plan A Comparison

See how Medicare Supplement Plan A compares to other plans.

Personalized Medigap Insurance Quotes

Don’t Confuse Medigap Plan A with Medicare Part A

Unfortunately, this mix-up happens more frequently than it should. Let’s make sure that doesn’t happen to you.

Medicare Part A is part of your Original Medicare benefits. It provides hospital insurance for all inpatient medical care. Meaning, if you’re admitted into a hospital, senior center, or treatment facility, your Medicare Part A benefits will be your coverage.

Medigap Plan A is one of the 10 supplement plan options that you can purchase through private insurance carriers as a secondary layer of coverage. It does not supply any additional services or care benefits; however, this policy does reduce your exposure to out-of-pocket medical costs.

Although its easy to get these two aspects of Medicare mixed up, it’s essential that you understand the difference.

How Much Does Medicare Supplement Plan A Cost?

The average monthly premium for Medicare Supplement insurance ranges between $50 – $300. Medigap Plan A is the lowest cost option because it provides less financial protection than other Medigap options.

The cost of your plan depends on several factors: Your age, tobacco use, state of residence, zip code, overall health status, and which insurance carrier you purchase from all affect the cost of your plan.

The only way to find out how much Medicare supplement plan A is for you is to request a personalized quote from one of our independent agents.

It’s also important to know Medigap policies are for one year at a time. Therefore, each year you can adjust your policy and enroll with whoever provides the lowest premium rates.

Find Your Best Policy & Price

Our specialized agency helps you shop and compare Medicare Supplement Companies side by side to find your best options. We’re here to answer all of your Medicare questions and help make enrollment quick and easy.

Our services are free. And there’s never any obligation when working with an agent.

Save time and money on your Medigap Plan A policy. Fill out the form on your screen to get started today.

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.