Medicare Supplement Plan C

Medicare Supplement Plan C provides robust benefits that work to save you thousands in out-of-pocket medical costs.

However, since January 1st, 2020, Medigap plan C is no longer available to individuals new to Medicare.

What Happened To Medicare Supplement Plan C?

In 2015 congress passed legislation called the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which help restructure Medicare for the growing senior population. One of the changes in this legislation was prohibiting supplemental insurance plans from covering the Medicare Part B annual deductible.

This change was made to discourage Medicare recipients from scheduling unnecessary office visits by requiring every Medicare beneficiary to pay the annual Part B deductible.

Medigap Plan C is one of two Medigap plans that provide coverage for the Part B deductible. The other being Plan F. As of January 1st, 2020, both these plans are no longer available for individuals new to Medicare.

What if I Already Own A Medigap Plan C Policy?

Anyone already enrolled in Medigap Plan C, or F can keep their plan as long as you were enrolled before December 31st, 2019. The changes of MACRA only apply to new Medicare enrollees.

Don’t Confuse Medicare Supplement Plan C with Medicare Part C

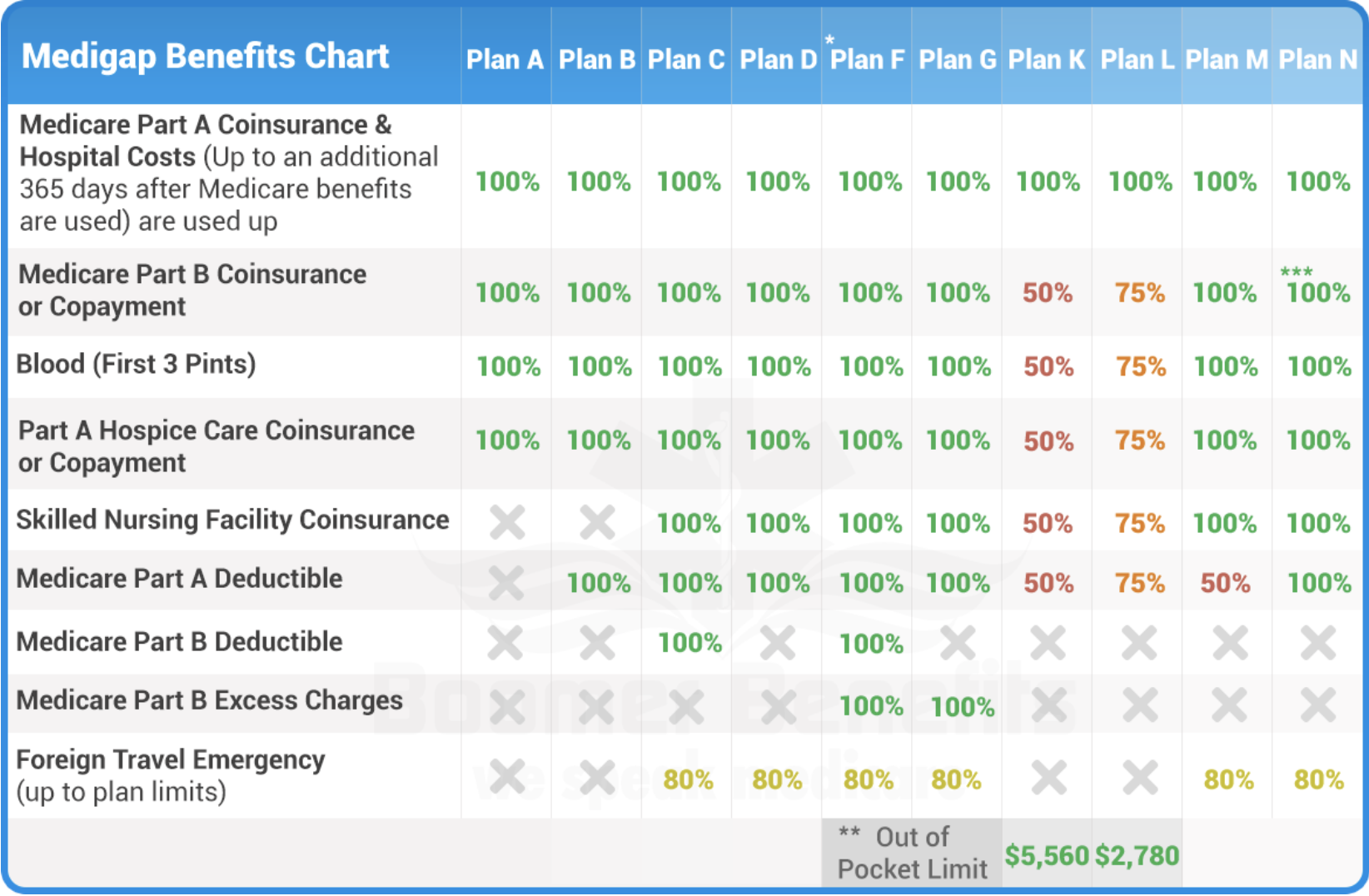

There are 10 Medicare Supplement Plans (Medigap) lettered A-N. Each plan covers a different set of financial gaps looming within Original Medicare in the form of copays, coinsurance, and deductibles. Medigap plan C is one of these 10 plans.

Medicare Part C, also known as Medicare Advantage, is the third installment of Medicare, which allows you to customize and expand your benefits to include vision, dental, hearing, and prescription drug coverage.

What Does Medicare Supplement Plan C Cover?

There are nine financial gaps within Original Medicare. Medicare Supplement Plan C covers eight of the nine gaps.

- Part A coinsurance

- Part B Coinsurance

- Blood – first 3 pints

- Part A Hospice Care Coinsurance

- Skilled Nursing Coinsurance

- Part A Deductible

- Part B Deductible

- Foreign Travel Exchange 80%

See How Medigap Plan C Compares

How Much Does Medicare Supplement Plan C Cost?

Medigap Plan C is one of the more comprehensive supplement plan options; therefore, it’s also more expensive compared to other plans. The average cost of Medicare Supplement Plan C ranges between $120 – $250 per month. However, keep in mind that the cost of your policy depends on your age, health status, state of residence, and zip code.

Finding Your Best Policy and Price

As with all insurance products, it’s always best to shop around before you buy. There are many insurance companies that sell Medigap policies, but not at the same price. If you’re interested in Medicare Supplement Plan C, we’re here to help you shop and compare Medicare Supplement Companies to find your best price.

We provide quick quotes. And we also make enrollment super simple. Our services are free. And there’s never any obligation when working with an agent. Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.