Medicare Supplement Plan K

Medicare Supplement Plan K is a cost-sharing policy that pays 50% towards all your out-of-pocket Medicare expenses.

This policy is affordable, easy to enroll, and goes a long way in protecting your health and bank account.

Cost Sharing Saves You Money

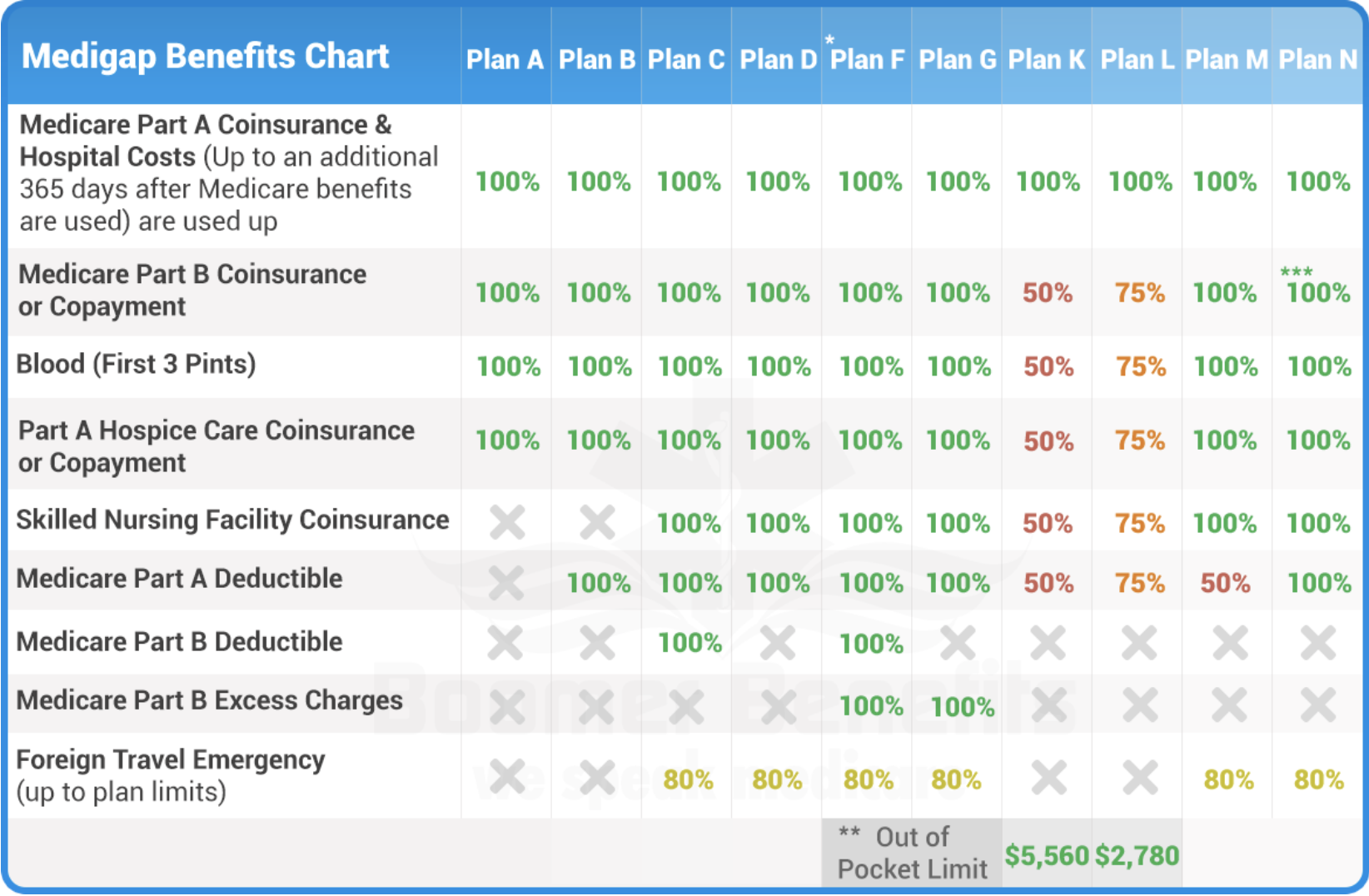

There are ten Medicare Supplement Plans lettered A-N. Each plan covers a different set of financial gaps looming within Medicare in the form of copays, coinsurance, and multiple deductibles.

Instead of covering a few of these financial gaps and leaving you exposed to others, Medicare supplement Plan K contributes 50% towards all your out-of-pocket Medicare expenses.

What Does Medicare Supplement Plan K Cover?

Part A coinsurance – Medicare Part A benefits only cover up to 60 days of inpatient medical care inside a hospital or treatment facility. After these benefits run out, you’ll pay a steep daily coinsurance of over $200 per day. Medigap Plan K extends your benefits for a full year. This is the only financial gap that Plan K covers in full.

Part A deductible at 50% – the annual Part A deductible in 2021 is $1,484. Therefore, you save $742 on this benefit alone.

Part B coinsurance 50% – Medicare Part B covers inpatient care services at 80%, and normally you would pay the remaining 20%. However, Plan K contributes 50% towards that 20%. This is the biggest liability in Medicare because there is no out-of-pocket maximum.

Blood (first 3 pints) 50% – pays 50% for the first three pints of blood.

Skilled Nursing 50% – Original Medicare only covers skilled nursing care for 20 days. After that, you’ll pay a daily coinsurance ranging between $200-$300. If you need extended care beyond 20 days, Plan K cost-shares at 50%.

Out-of-Pocket Limits for Financial Protection – Only two Medigap policies give set out-of-pocket maximums, Plan K and Medigap Plan L. If you enroll in Medicare Supplement Plan K, you’re out-of-pocket maximum is $6,220.

What Medigap Plan K Does Not Cover

There are three areas that Medigap Plan K does not cover.

Part B deductible – The annual deductible for your Part B benefits in 2021 is $204. As of 2020, Medigap can no longer offer coverage for the Medicare Part B deductible. Therefore, Medigap Plan F and Medigap Plan C have been discontinued and no longer available for individuals new to Medicare. All Medicare beneficiaries must pay this deductible.

Part B excess charges – Medicare allows care providers to bill the patient directly up to 15% beyond what Medicare covers. These are Excess Charges. Only two policies cover Part B excess charges, Medigap Plan F, and Medigap Plan G. If you have any excess charges, Plan K does not contribute 50%.

Foreign Travel Exchange – five of the ten supplement plans offer foreign travel exchange coverage at 80%. Medigap Plan K does not provide any foreign travel coverage. Therefore, individuals who plan to travel abroad in the upcoming year should consider other Medigap policies covering this gap.

See How Medicare Supplement Plan K Compares

How Much Does Medicare Supplement Plan K Cost?

Cost-sharing plans not only save you money in out-of-pocket costs, but they also have lower-cost premiums compared to the other Medigap plans.

The final cost of your policy depends on your age, health, state of residence, zip code, and insurance provider. However, the average cost of Medicare Supplement plan K ranges between $41 – $121 per month.

Who Should Consider Buying This Policy?

Medigap Plan K is one of the least popular choices for Medigap. However, it is our opinion that its low popularity is due to confusion on how cost-sharing plans work. Plan K is great for any individuals who want to add a secondary layer of protection but do not want to pay the higher premiums for the more comprehensive policies. The out-of-pocket maximum that this plan provides should be desirable to individuals who have chronic health conditions and plan on using their Medicare benefits frequently in the upcoming year.

Finding Your Best Rate

Individuals who go about the shopping process frequently over-pay for their Medigap coverage. Premium rates can vary as much as 30% between insurance providers, and you must shop and compare all of them before making a purchase.

Our independent insurance agency is here to help you shop and compare Medicare Supplement Insurance companies side by side to help you quickly navigate to your best policy. We save our clients time and money. And did we mention that our services are free?

We’ve helped thousands of individuals protect their health and their bank account with affordable Medigap coverage. We’d love to help you too!

Explore your options today. Fill out the form on your screen to get started.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.