Medicare Supplement Plan G

Medicare Supplement Plan G is the most comprehensive Medigap plan available; and ensures you pay as little as possible out-of-pocket for your Medicare benefits.

It’s also the number one selling Medigap option. We strongly suggest exploring what this policy has to offer.

The Need For Medicare Supplements

Although Medicare provides excellent health care coverage, it’s far from complete. Looming within Medicare are multiple deductibles, coinsurance, and copays. As a result, these financial gaps leave you exposed to high out-of-pocket costs every time you use your benefits.

Medicare Supplemental insurance (Medigap) fills these financial gaps to reduce or eliminate out-of-pocket Medicare costs. These policies protect your health, bank account, and bring peace of mind. It’s no wonder that (81%) of Medicare Beneficiaries own some form of supplemental coverage.

Medigap policies are affordable, easy to enroll, and policies only last one year at a time. Therefore, if your needs change, it’s easy to change your policy.

Why Medicare Supplement Plan G Is So Popular

For over a decade, Medigap Plan F has been far and away from the most popular choice for Medigap coverage. However, starting January 1st, 2020, Plan F is no longer available to individuals new to Medicare. This change was a result of recently passed legislation in congress which removed plans that covered the annual Medicare Part B deductible.

Now that Plan F is no longer available, Medicare Supplement Plan G has seen the highest enrollment growth and now sits as the number one Medigap option because it covers all financial gaps allowed by supplemental coverage.

What Does Medicare Supplement Plan G Cover?

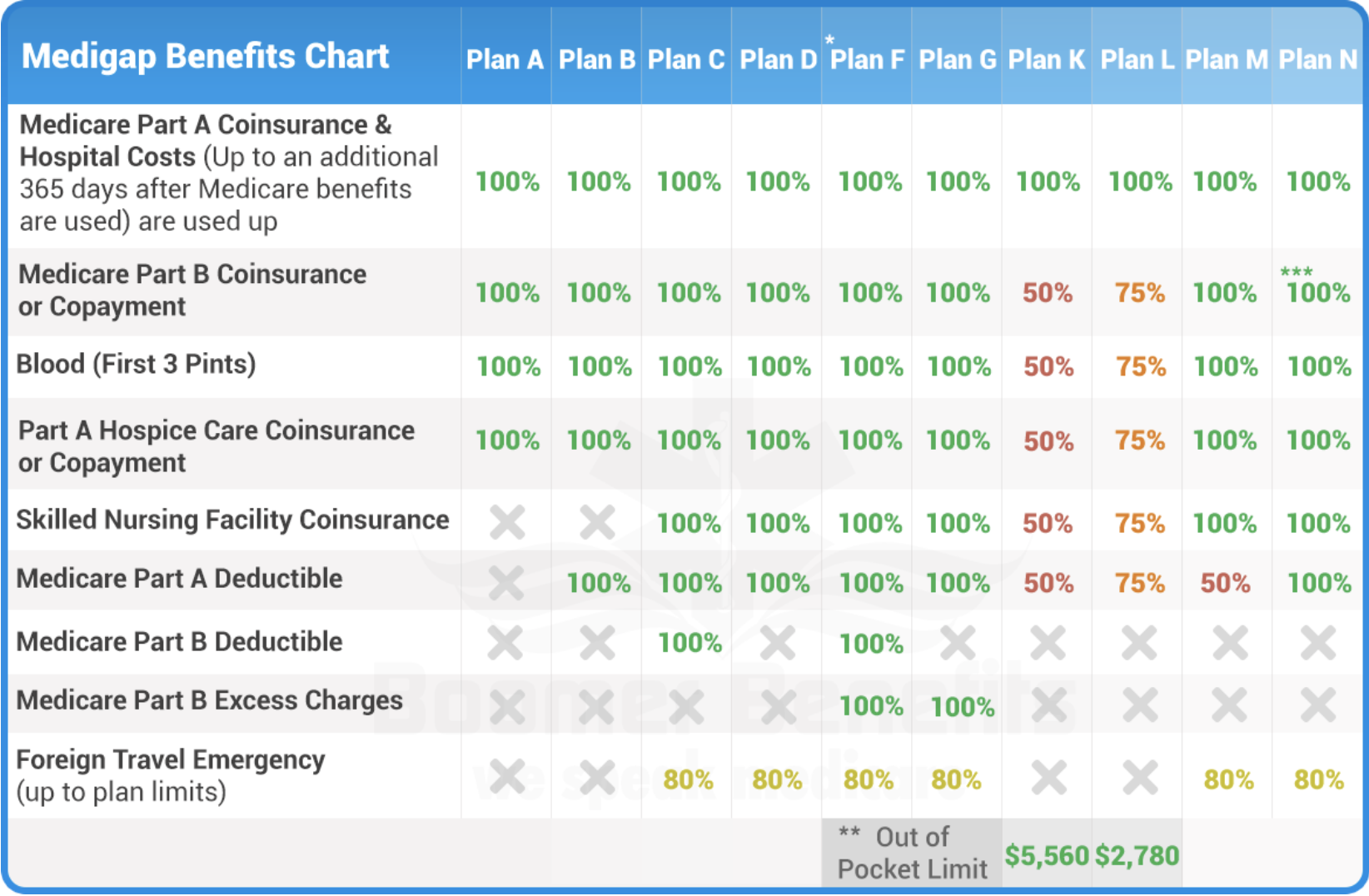

As shown in the comparison chart below, Medigap Plan G covers all but one financial gap in your Medicare benefits.

- Part A coinsurance – Original Medicare covers up to 60 days for inpatient care in a hospital. After that, you’ll pay a steep daily coinsurance. Medigap Plan G extends your coverage to 100 days.

- Part A deductible – in 2020, the standard deductible is $1,364. Plan G covers this in full.

- Part B coinsurance – Medicare pays 80% of your out-patient care, and you pay the remaining 20%. There is no out-of-pocket maximum, which makes this the most significant gap in Medicare. All supplement plans cover this gap.

- Blood – First three pints

- Skilled nursing care – without Medigap, Original Medicare only covers the first 20 days in a nursing facility in full. After that, you will pay a daily coinsurance upwards of $200 per day!

- Foreign Travel Exchange – pays 80% towards out-of-country medical care after a small deductible.

- Part B Excess Charges – Medicare can charge you up to 15% more than what is covered by Medicare. These are known as Excess Charges. Supplement Plan G is one of the few plans that cover this gap.

What Medigap Plan G Doesn’t Cover

Medicare Supplement plan G covers all but one financial gap within Medicare.

Part B deductible – the standard Part B deductible in 2020 is $203. All Medicare beneficiaries are now required to pay this deductible, which is why Medigap Plan F and Medigap Plan C are no longer available. If you enroll in Medigap Plan G, this is your only out-of-pocket Medicare cost.

* Out-of-pocket Limits – only two Medigap policies set out-of-pocket limits, Medigap Plan K and Medigap Plan L. However, because Plan G covers all but one financial gap, there’s no need to set an out-of-pocket limit. The maximum you’ll pay out-of-pocket is $203, which is the annual Part B deductible.

Compare Your Options

Who Should Consider Buying Medigap Plan G?

Medigap Plan G is designed for two groups of people.

1. Individuals in poor health and will likely use their Medicare benefits. Every time you use your benefits, you’ll be saving in out-of-pocket costs.

2. Individuals who want comprehensive coverage for peace of mind. If you have good to moderate health, you may not use your Medicare benefits as much as others. However, Medigap plan G provides peace of mind and financial protection if the unexpected comes your way.

How Much Does Medicare Supplement Plan G Cost?

According to medicare.gov, the average cost of Medicare Supplement Plan G ranges between $190 – $480 per month.

The actual cost of your policy depends on your age, health status, sex, state of residence, zip code, smoking status, and which insurance provider you purchase from.

If you’re shopping for the lowest price, it’s essential that you work with an independent agency and not go about the shopping process alone. Our independent agency helps you shop and compare Medicare Supplement Insurance companies side by side to make sure you get the lowest price available.

Our services are free. And there’s never any obligation when working with an agent.

Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.