Medicare Supplement Plan M

Medicare Supplement Plan M is a low-cost Medigap policy that can save you thousands in out-of-pocket medical expenses.

It covers all the major gaps in Medicare and provides cost-sharing for the others. It’s the newest Medigap policy available and designed for today’s seniors.

Medicare Supplement Plan M is the Newest Medigap Policy

Medigap M is of the new offerings created by the Medicare Modernization Act, signed into law in 2003. Though that may not seem ‘new’, all other Medigap plans were designed in 1980.

Who Should Consider Medigap Plan M?

Medigap Plan M is designed for individuals who are in moderately good health and don’t expect frequent hospital visits. It covers the biggest financial gaps in Medicare and provides cost-sharing on the others. In exchange for cost-sharing the Medicare Part A deductible, premiums for this policy are low.

Individuals with chronic health conditions would be better served with a more comprehensive policy such as Medigap Plan G or Medigap Plan F.

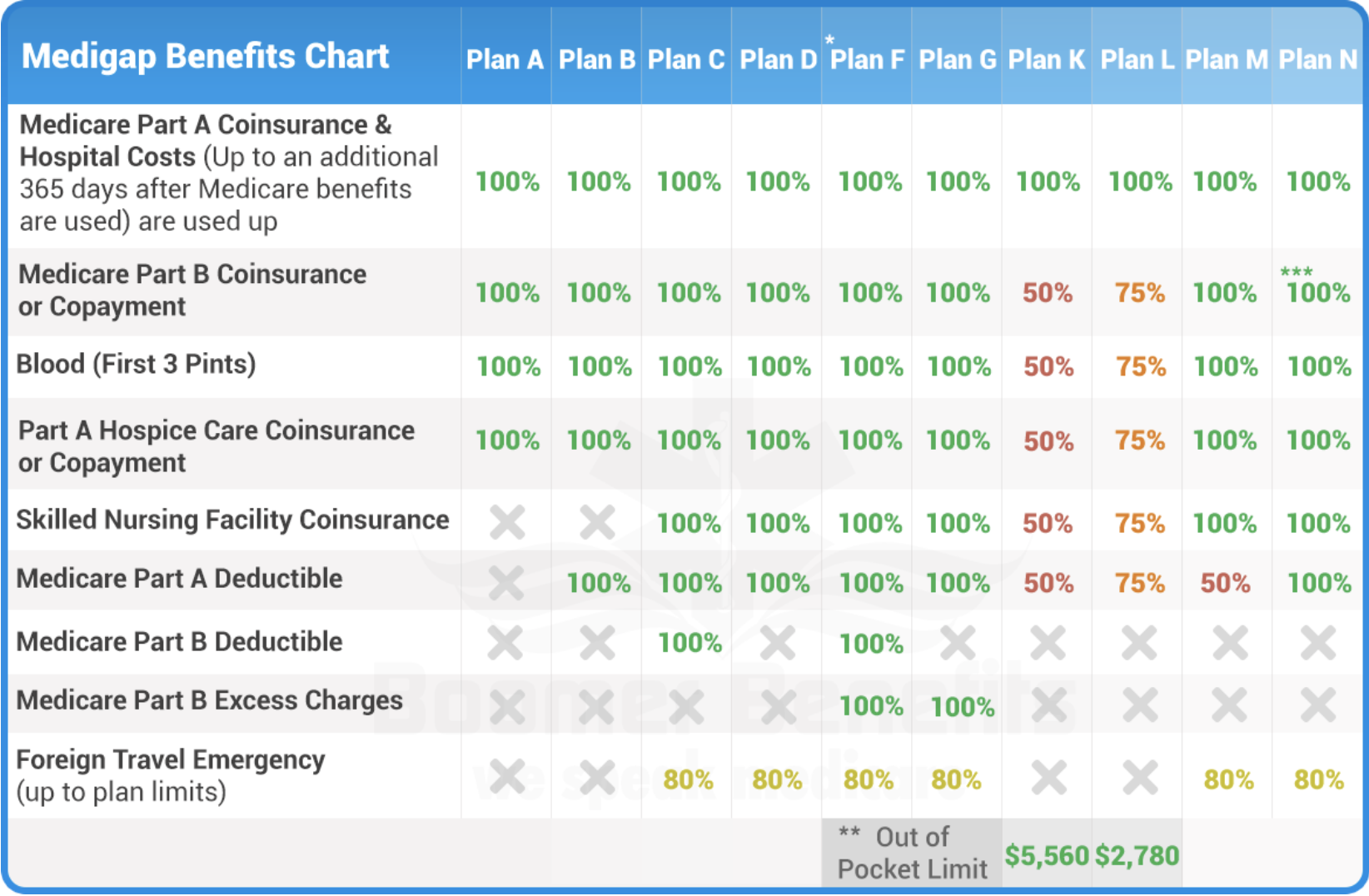

What Does Medicare Supplement Plan M Cover?

Part A coinsurance – If you need an inpatient medical stay in a hospital, Plan M covers the out-of-pocket cost for one full year.

Part A deductible 50%– the standard Part A deductible in 2021 is $1,484. Plan M pays a 50% share of this deductible. That’s an automatic savings of $742!

Part B coinsurance– without Medigap coverage, you’ll pay 20% for all office visits, testing, and outpatient care services. All Medigap policies cover this gap and ensure you never pay out-of-pocket for outpatient medical care.

Blood (first 3 pints) – This plan provides full coverage for the first three pints of blood.

Skilled Nursing Facility – Original Medicare only covers 20 days of skilled nursing care. After that, you’ll pay a steep daily coinsurance of nearly $200 per day. Plan M covers this coinsurance too.

Here’s What Medigap Plan M Doesn’t Cover

Medicare supplement plan M covers all but the following two gaps.

Part B deducible – the standard part B deductible in 2020 is $204. As of January 2020, Medicare no longer allows Medigap policies to provide these benefits. Therefore, all Medicare beneficiaries will pay the Medicare Part B deductible.

Part B excess charges – Most states allow doctors to charge the patient up to 15% more than what Medicare covers as excess charges. Plan M does not fill this gap.

How Does Medicare Supplement Plan M Compare?

What Does Medicare Supplement Plan M Cost?

The overall cost of your policy depends on your age, health, state of residence, zip code, and health insurance provider; however, compared to other Medigap options, Plan M is one of the lower-cost policies.

Prices vary as greatly from state to state, however, the average cost for Medigap plan M ranges between $100-$210.

Finding Your Best Policy

It’s important to know that Medicare standardizes all Medigap policies. Meaning, that all lettered plans contain the same benefits no matter which company you purchase from. The price, however, does fluctuate drastically between carriers, which is why it’s so important to shop and compare before purchasing.

Working with an Independent Agency

Our independent agency helps you shop and compare Medicare Supplement Insurance Companies nationwide so you can quickly find your best policy and price.

Our services are free, and there’s never any oblation when working with an agent. We’ve helped thousands of seniors customize their Medicare benefits to protect their health and their finances. We’d love to help you too!

Explore your options today. Get your free Medicare Supplement Plan M Quote by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.