Medicare Supplement Plan F

Medicare Supplement Plan F is the most popular Medigap policy and has been for many years.

However, as of January 1st, 2020, Plan F is no longer available to individuals new to Medicare.

Why Is Medicare Supplement Plan F No Longer Available?

In 2015 congress passed legislation called the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which updated and restructured Medicare to support the aging baby boomer population. One of the legislative changes was prohibiting supplemental insurance plans from covering the Medicare Part B annual deductible. Something that both Plan F and Plan C covered.

This change aims to discourage individuals from scheduling unnecessary office visits by requiring all beneficiaries to pay the annual Part B deductible. As of 2020, individuals new to Medicare can no longer purchase Medicare Supplement Plan F. However, individuals enrolled before January 1st, 2020, can still enroll in.

Why is Medigap Plan F so Popular?

Although Original Medicare provides excellent health care coverage, it’s far from perfect. Looming within Medicare are copays, coinsurance, and multiple deductibles, which, as a result, leave you paying out of pocket every time you use your benefits.

Supplemental policies provide a secondary layer of coverage to fill in these financial gaps, reducing or eliminating out-of-pocket medical costs.

Medicare Supplement Plan F has been the most popular Medigap policy because it covers all the financial holes in Medicare and ensures that you never pay out-of-pocket for Medicare benefits.

What Does Medicare Supplement Plan F Cover?

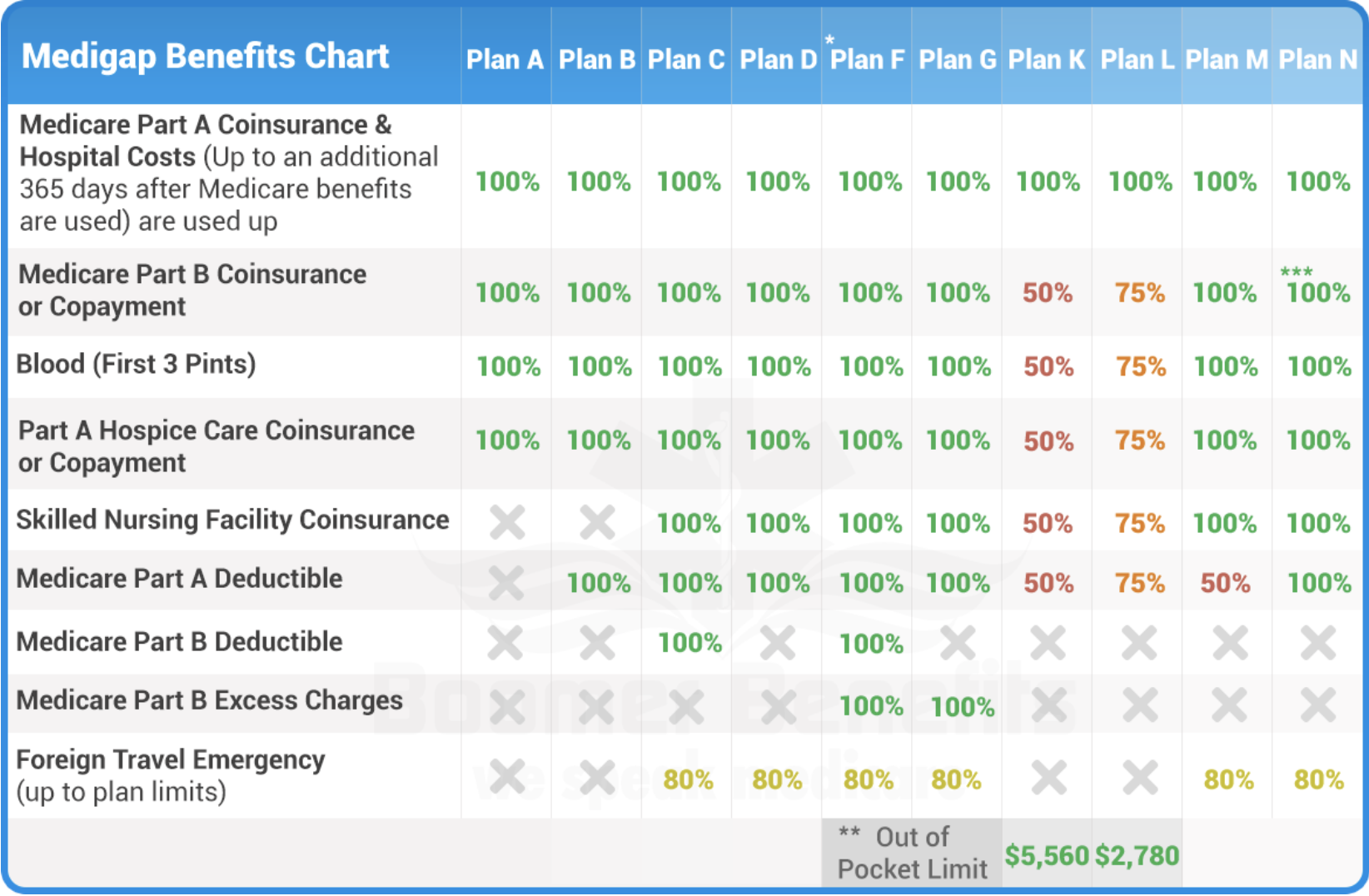

There are nine financial gaps in Original Medicare. Medigap Plan F covers them all.

- Part A coinsurance

- Part B coinsurance

- Blood – first 3 pints

- Part A Hospice Care Coinsurance

- Skilled Nursing Coinsurance

- Part A Deductible

- Part B Deductible

- Foreign Travel Exchange 80%

See How Medigap Plan F Compares

What’s the Next Best Plan If I Can’t Buy Plan F?

As you can see in the chart above, Medigap Plan G is the most comprehensive plan available to individuals new to Medicare. It covers all the financial gaps within Medicare now that everyone must pay the Part B deductible. Even better is that plan G is cheaper than plan F.

How Much Does Medicare Supplement Plan F Cost?

Because Plan F covers all out-of-pocket Medicare costs, the premiums are higher than all the other plans. That’s not to say it’s not worth the price. Plan F has been the number one Medigap option for over a decade because the monthly premium is still far lower than what most people pay out-of-pocket for their medical care.

The average cost of Medigap Plan F ranges between $140 – $210. However, the actual cost of your policy depends on your age, health, state, zip code, and which company you purchase from.

Finding Your Best Policy & Price

If you’re eligible to enroll in Medicare Supplement Plan F then it’s essential that you shop around before you buy. Premium rates can range up to 30% between carriers.

Our independent insurance agency is here to help you shop and compare Medicare Supplemental Insurance companies side by side to help you find your lowest cost option. If you’re not eligible for Plan F, we’ll help you find the policy that best fits your needs and budget.

Our services are free. And there’s never any obligation when working with an agent.

Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.