Medicare Supplement Plan N

Medicare Supplement Plan N is a low-cost Medigap policy that’s loaded with value.

This popular plan covers all but one of the financial gaps within Medicare and can save you thousands in out-of-pocket medical costs.

The Growing Need For Medigap

Although Original Medicare provides excellent health care coverage, it’s far from complete. Looming within Medicare are coinsurance, copays, and multiple deductibles, leaving you exposed to high out-of-pocket medical expenses.

Medicare Supplemental Insurance (Medigap) are private health insurance plans that provide a secondary layer of coverage to protect against these financial gaps within Medicare. Medigap policies work to reduce or eliminate out-of-pocket Medicare costs protecting both your health and bank account.

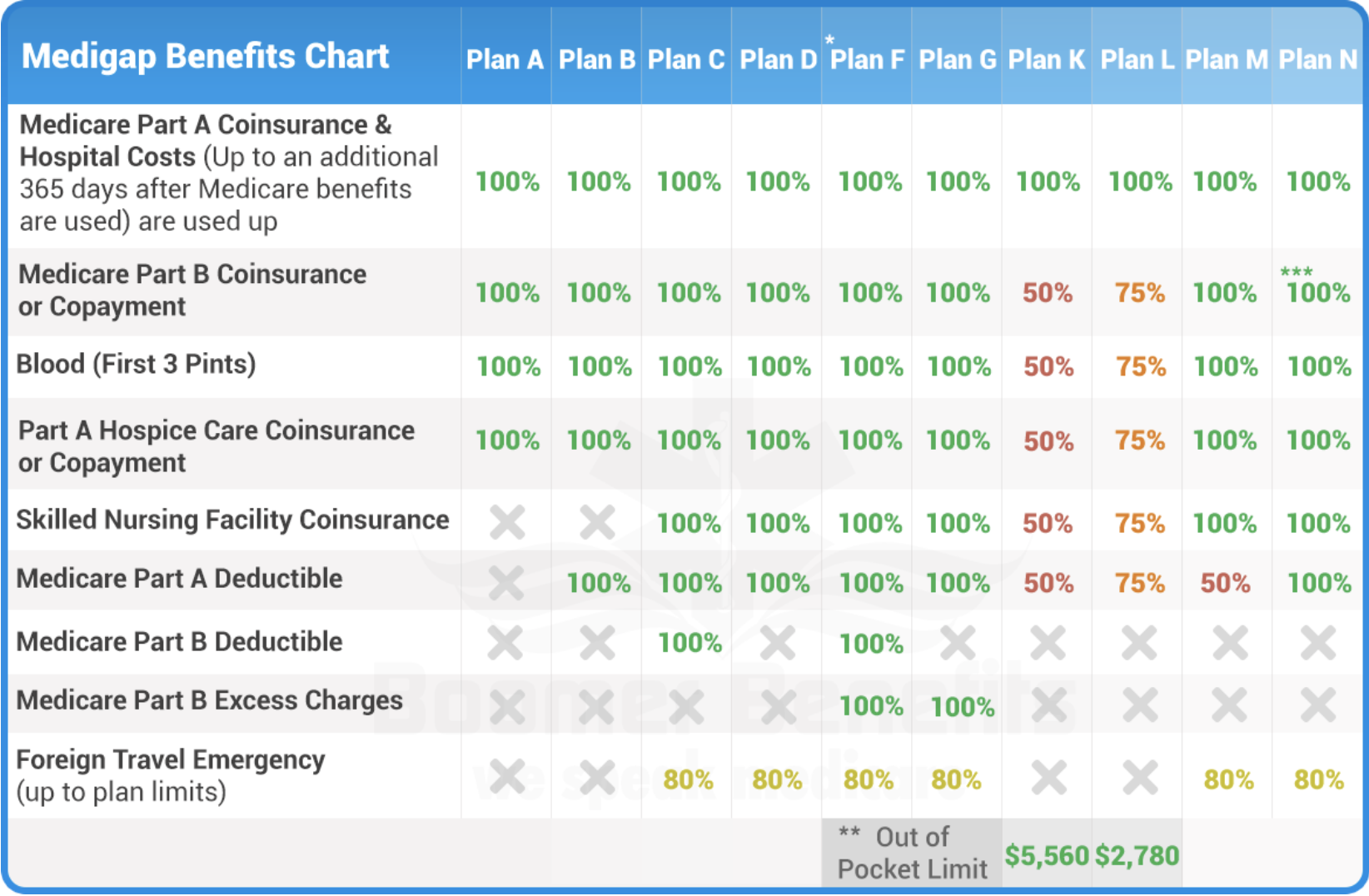

There are 10 Medigap plans lettered A-N. Each plan covers a different set of gaps in Medicare. Medicare Supplement Plan N is the newest and one of the most popular policy options because it coves seven of the eight possible financial gaps. Additionally, it’s costs less than Medigap Plan G, and Medigap Plan F.

What Does Medicare Supplement Plan N Cover?

Medigap Plan N covers 7 of the 8 Medicare financial gaps.

Part A Coinsurance – Medicare Part A covers your inpatient hospital care up to 60 days in full; after that, you’ll pay a steep daily coinsurance that can be hundreds of dollars per day. Plan N extends your coverage for one full year and pays all coinsurance during this time.

Part A Deductible – The standard deductible for Medicare Part A in 2021 is $1,484. Plan N covers this deductible 100%. That’s money that stays in your pocket.

Part B Coinsurance – Medicare Part B pays 80% of all outpatient medical care, while the patient pays the remaining 20%. All Medigap policies cover this coinsurance in full which is significant because it’s the gap that has the highest out-of-pocket potential.

Blood – First three pints at 100%

Skilled Nursing Facility – Original Medicare only skilled nursing facilities for the first 20 days. Medigap plan N extends this coverage for 100 days and pays the full coinsurance costs.

As you can see, this policy gives you robust financial protection, so you’re prepared no matter what comes your way.

What Medigap Plan N Doesn’t Cover

There are only two financial gaps that Medigap Plan N does not cover.

Part B Deductible – the standard Medicare Part B deductible in 2021 is $204. As of 2020, no Medigap policy can provide this benefit, and all Medicare beneficiaries must pay their Part B deductible.

Part B Excess Charges – some states allow Medicare providers to bill the patient up to 15% more than what Medicare covers for care services. These are known as excess charges and are the only financial gap in which you might pay out-of-pocket if you purchase Medigap Plan N.

How Does Medicare Supplement Plan N Compare?

Who Should Consider Buying Medigap Plan N?

Everyone has different life circumstances, which is why there are ten different Medigap options. The right plan for you will depend on your age, health, state of residence, gender, and monthly budget.

Medicare Supplement Plan N is a robust policy that will fit well with individuals who foresee using their Medicare benefits frequently in the upcoming year. While the premiums are higher than other Medigap options, you’ll save money every time you use your Medicare benefits. Individuals with severe or chronic health conditions could save thousands of dollars with Medigap Plan N.

Healthy individuals may also choose Plan N as a secondary layer of protection just in case the unexpected comes their way. Remember, when you’re sick, no one ever complained about having too much coverage.

Comparing Rates & Finding Your Best Option

Did you know that rates for the same plan can vary as much as 30% between insurance carriers? Its true, which is why it’s critical that you take the time to shop all your options before making a purchase.

Our independent insurance agency is here to help you compare Medicare Supplement Insurance companies nationwide so you can quickly find your lowest cost option. We also have a streamlined enrollment process.

We’ve helped thousands of seniors customize their Medicare benefits to protect their health and their finances. We’d love to help you too!

Did we mention our services are free?

Explore your options. Get your Free quote for Medicare Supplement Plan N today by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.