Medicare Supplement Plan L

Medicare Supplement Plan L is a cost-sharing policy that pays 75% of all your out-of-pocket Medicare expenses.

This affordable policy can go a long way in protecting your health and bank account.

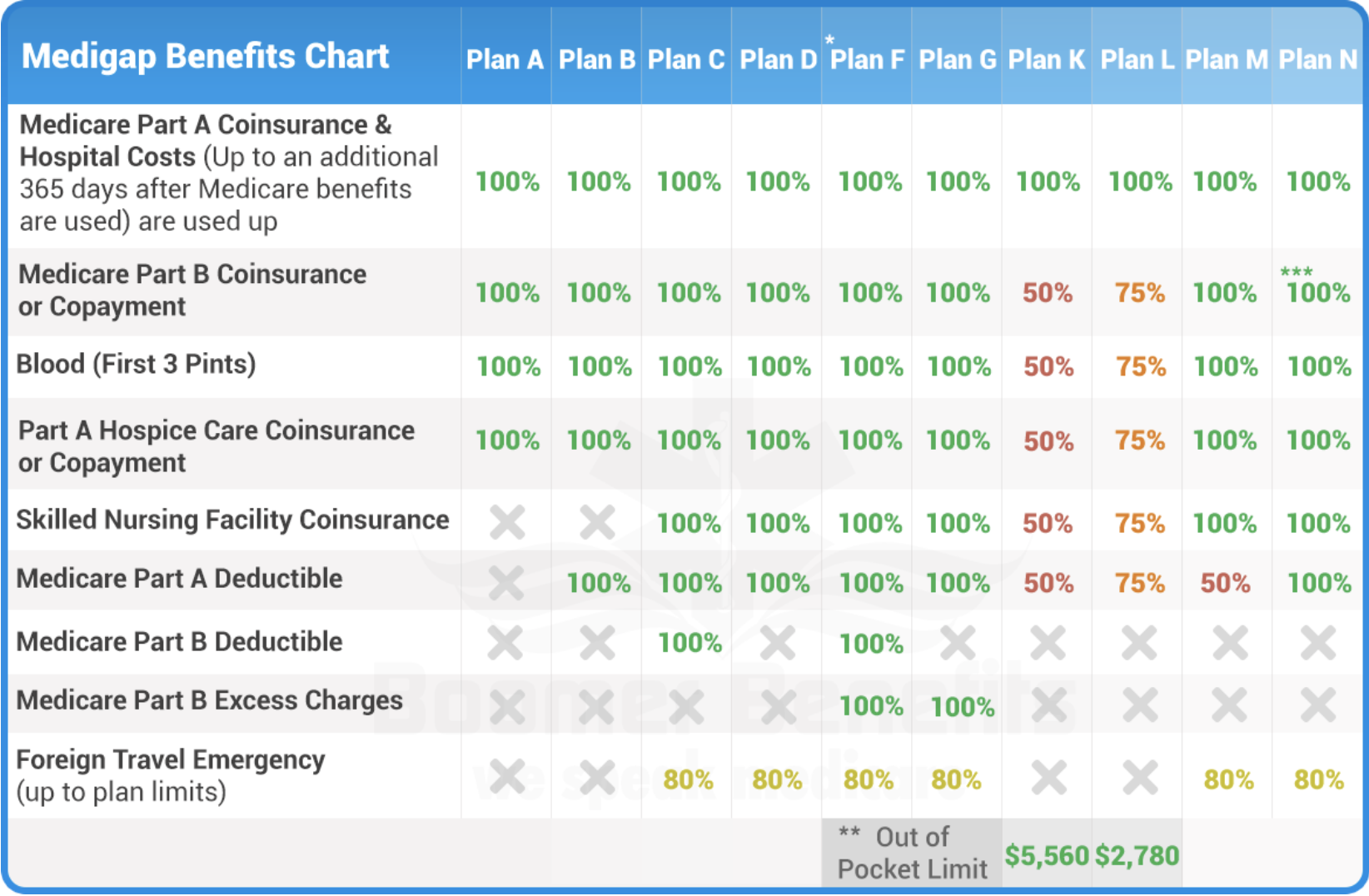

There are 10 Medicare Supplement Plans (Medigap) lettered A-N. Each plan covers a different set of financial gaps within Original Medicare. Medigap Plan L covers six of these gaps at 75%.

What Does Medicare Supplement Plan L Cover?

As shown in the comparison chart below, Plan L shares cost on six of the nine gaps existing in Original Medicare.

Part A coinsurance – Medicare Part A provides coverage up to 60 days of inpatient medical care in a hospital or treatment facility. Without Medigap coverage, you’d be left paying the full amount after these benefits run out. Medigap Plan L extends your coverage for one full year. This is the only gap that Plan L covers in full.

Part A deductible at 75% – The 2021 standard deductible for Part A is $1,484. Medigap Plan L pays 75% of this deductible, saving you $1,113 on this benefit alone.

Part B coinsurance 75% – Medicare Part B covers all outpatient medical care such as office visits, testing, specialist ext. Without Medigap coverage, you’ll pay 20% coinsurance for all outpatient medical care. Medicare Supplement Plan L contributes 75% towards whatever amount is your patient responsibility.

Blood (first 3 pints) 75% – This plan pays 75% for the first three pints of blood.

Skilled Nursing 75% – Original Medicare only provides coverage for the first 20 days of skilled nursing care. Without a Medigap policy, you’ll pay a daily coinsurance upwards of $200 per day every day after that. Medigap Plan L also contributes 75% of this coinsurance cost.

Out-of-Pocket Maximum for Financial Protection – One of the biggest benefits of enrolling in Medicare Supplement Plan L is the maximum out-of-pocket limit. Plan L and Medigap Plan K are the only two Medigap options that have out-of-pocket maximums. All other policy options leave you exposed to potential catastrophic medical bills. In 2021, the out-of-pocket maximum for Plan L is $3,110.

What Medigap Plan L Doesn’t Cover

Medicare Supplement Plan L covers all out-of-pocket costs except for the following:

Part B deducible – The standard Part B deductible in 2021 is $204. As of January 2020, Medigap plans are no longer able to include this coverage. Therefore, all Medicare beneficiaries must pay the Part B deductible.

Part B excess charges – Some states allow for care providers to the bill, you, the patient, up to 15% more than what’s covered by Medicare. These are known as excess charges. Plan L does not protect you against Part B excess charges. However, the out-of-pocket maximum still applies.

Foreign Travel Exchange – Medigap Plan L does not include any foreign travel health insurance protection. Several supplement plans include foreign travel benefits after a $250 deductible. If you’re considering some out-of-country travel in the upcoming year, we highly recommend you choose one of those other options.

How Does Medicare Supplement Plan L Compare?

Who Should Consider This Policy?

Cost-sharing plans fit all sorts of life circumstances. However, Plan L will be particularly desirable for individuals with chronic health conditions but don’t want to pay the higher premiums for more comprehensive policies such as Plan F or Plan G.

If you foresee using your Medicare benefits frequently in the upcoming year, then we strongly suggest exploring your options with Medigap Plan L.

Shopping Quotes & Carriers

Did you know that premium rates for the same policy can vary as much as 30% between carriers? It’s true. And it’s the reason why it is so important to shop and compare all the top carriers before you enroll.

Our independent agency is here to help you quickly navigate to your best policy and price. We’ll help you shop and compare Medicare Supplement Insurance companies side by side, so you know you’re getting the lowest cost option.

Our services are free. And there’s never any obligation when working with an agent.

Get your personalized quote for Medicare Supplement Plan L today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.