Medicare Supplement Plan B

Medicare Supplement Plan B is a simple, low-cost policy that can save you thousands of dollars in out-of-pocket medical costs.

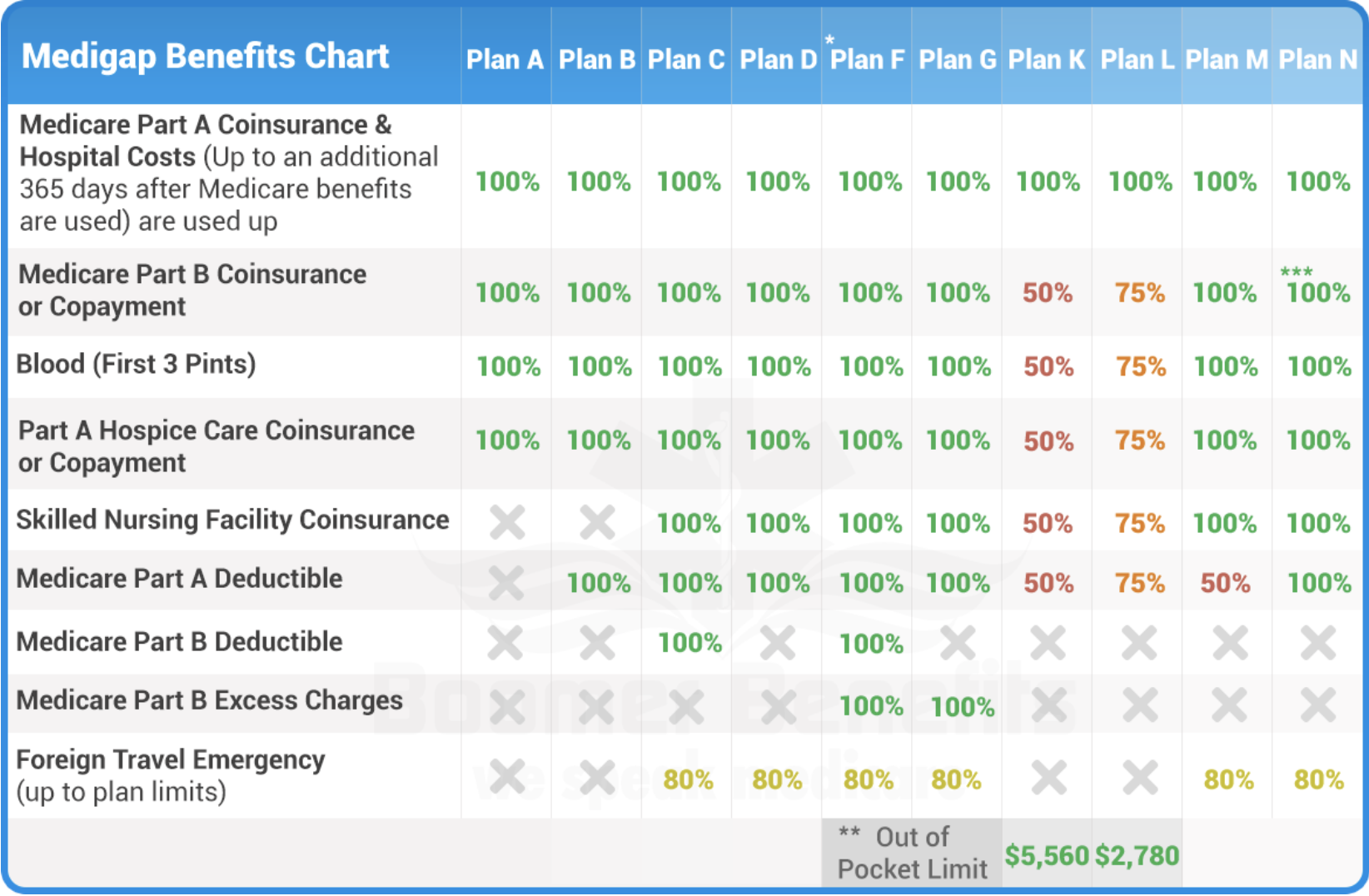

Below we take a look at the benefits included in Medigap Plan B.

Quick Review of Why So Many People Choose Medigap

Although Original Medicare provides excellent health care coverage, it’s far from comprehensive. Looming within Medicare are copays, coinsurance, and multiple deductibles that can lead to high out-of-pocket costs.

Medicare Supplement Insurance (Medigap) fills these financial gaps to reduce or eliminate out-of-pocket medical expenses. There are 10 Medigap plans lettered A-N. Each plan covers a different set of gaps, which provides options for every type of budget. Medigap policies are affordable and easy to enroll. It’s no wonder that today 81% of all Medicare Beneficiaries have some form of supplemental coverage.

Don’t Confuse Medigap Plan B with Medicare Part B

Understanding the different parts of Medicare can be confusing. Here’s a quick review.

- Medicare Part A – doctors insurance

- Medicare Part B – hospital insurance

- Medicare Part C – Medicare Advantage

- Medicare Part D – prescription drug coverage

Medicare Supplement Insurance policies A-N are additional forms of coverage that work alongside the four parts of Medicare to reduce out-of-pocket medical costs.

What Does Medicare Supplement Plan B Cover?

This simple policy covers five of the most important coverage gaps within Medicare.

Medicare Part B Coinsurance – Without supplemental coverage, you’ll pay 20% of all your outpatient medical costs. This includes doctor’s visits, testing, specialist, and any care where you’re not admitted into a hospital. Paying 20% for each service adds up quickly. And worse, there’s no maximum limit in which you might pay. This is the biggest financial gap within Medicare and is covered by all Medigap policies.

Medicare Part A Deductible – the annual Part A deductible for 2021 is $1,484. You must pay this deductible before receiving any of your Part A benefits. There’s also the possibility of paying this deductible multiple times if inpatient medical stays are over 60 days apart. Medicare Supplement Plan B covers this deductible no matter how many times you need it.

Medicare Part A Coinsurance & Hospital Costs – without supplemental coverage Medicare Part A only covers 100 days of inpatient medical care. Medigap Plan B extends your coverage up to 365 days. This benefit is critical, especially to individuals without long-term care insurance.

Blood – first three pints

Hospice Copayments – if you need hospice care, Medigap plan B covers any out-of-pocket copayments.

Compare Medigap Plan B

How Much Does Medicare Supplement Plan B Cost?

As shown in the chart above, Medigap plan B fills some but not all the gaps in Medicare. The gaps covered to determine the cost of the policy premium. The more simple plans cost less, and the more comprehensive plans cost more. Your age, gender, smoking status, and zip code are also factors in determining your monthly premium. The only way to know the full cost of Medigap plan B is to request a personalized quote from one of our helpful agents. However, the rough estimate cost of Medicare Supplement Plan B ranges between $160 – $209 per month.

Finding Your Best Policy

If you’re interested in buying Medicare Supplement Plan B, your next step is to shop and compare Medicare Supplement Insurance companies to find which carrier can offer you the best price. Our independent insurance agents are here to help you do just that. We help you quickly shop all the carriers operating in your state and pull quotes fast. If you decide to move forward with a purchase, we make enrollment super simple.

Our service is free. And there’s never any obligation when working with an agent.

Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.