Medicare Supplement Plan D

Medicare Supplement Plan D is a popular Medigap option that provides robust benefits and affordable premium rates.

Below we dig deeper into what this policy has to offer.

Why Medigap Is Needed

Although Medicare provides excellent health care coverage, it’s far from comprehensive. Looming within Original Medicare are copays, coinsurance, and multiple deductibles that can lead to high out-of-pocket medical costs. Without a Medigap policy, you’ll pay out of pocket every time you use your Medicare benefits.

Medicare Supplemental Insurance (Medigap) is a secondary layer of coverage that works to reduce or eliminate out-of-pocket medical expenses.

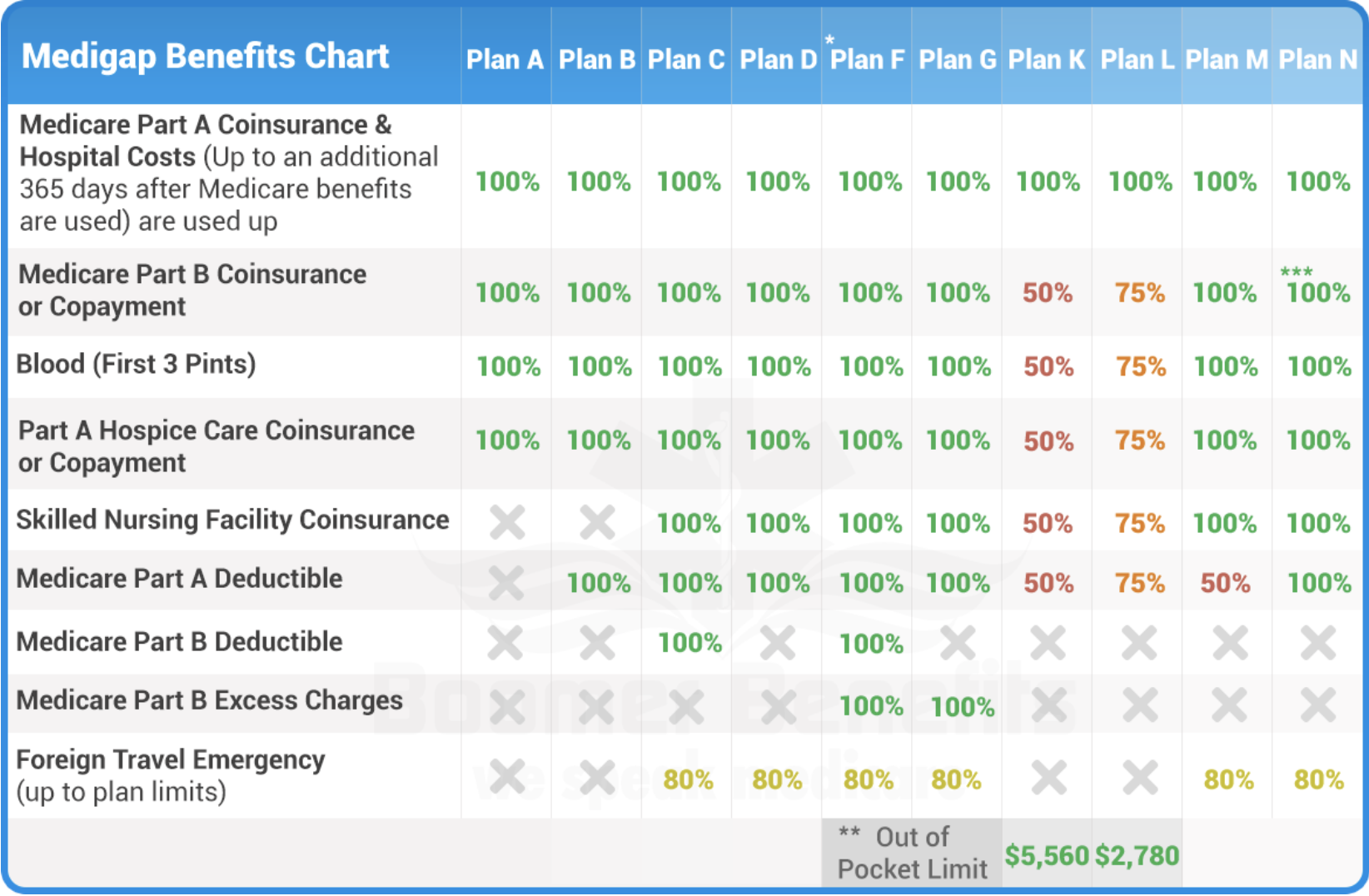

There are 10 Medigap plans lettered A-N. Each plan covers a different set of gaps within Medicare. Medicare Supplement Plan D covers all but two of these financial gaps. (see chart below)

Understanding the Difference Between Medigap Plan D & Medicare Part D

It’s easy to confuse Medigap Plan D for Medicare Part D. However, these are two separate pieces of Medicare, and it’s essential that you understand the difference.

Medicare Basics:

- Medicare Part A – Hospital insurance covers all inpatient medical care.

- Medicare Part B – Doctors insurance covers office visits and outpatient medical care.

- Medicare Part C – Medicare Advantage.

- Medicare Part D – Prescription drug coverage.

Medicare Supplement Plan D helps fill the financial gaps with your Original Medicare benefits by covering copays, coinsurance, and deductibles. Medicare Part D expands your benefits to include prescription drug coverage.

What Does Medicare Supplement Plan D Cover?

Medigap Plan D covers seven of the nine financial gaps in Medicare. Here’s what it covers:

- Part A coinsurance

- Part B coinsurance

- Blood – first three pints

- Part A hospice care coinsurance

- Skilled nursing coinsurance

- Part A deductible

- Foreign travel exchange 80%

What Medigap Plan D Doesn’t Cover

There are only two gaps that Medigap Plan D doesn’t cover.

Part B deductible: the standard deductible for Part B benefits in 2021is $203. Congress recently passed legislation that no longer allows for any Medigap policies to cover this gap. Therefore, no matter which policy you choose, you’ll still pay the yearly Part B deductible.

Part B excess charges: most states allow doctors to bill patients up to 15% above what Medicare covers. These are called excess charges, and Medigap Plan D does not cover these charges.

How Does Medicare Supplement Plan D Compare?

Who Should Consider This Plan?

The reason why there are 10 separate supplement options is that everyone has different needs.

Medicare Supplement plan D is a great choice for individuals who expect to use their Medicare benefits somewhat frequently over the upcoming year. Having this plan will save you money every time you use your Medicare benefits. Medigap Plan G is the only plan which provides more coverage; however, it also has higher premiums.

If you have chronic health issues, we strongly suggest exploring Medigap Plan D or Plan G.

Finding Your Best Policy

Finding your best policy and price depends on many different factors: your age, state of residence, zip code, and overall health status. However, the biggest factor in finding your best policy is choosing to work with an independent agency.

Our independent agency helps you shop and compare Medicare Supplement Insurance companies side by side. Did we mention that our service is free?

We help you quickly locate your best policy option and even streamline the enrollment process. Our services are free. And there’s never any obligation when working with an agent.

We’ve helped thousands of individuals customize their Medicare benefits to protect both their health and bank account. We’d love to help you too!

Explore your options today. Get started by filling out the form on your screen.

Personalized Medigap Insurance Quotes

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.