Life Insurance with Kidney Cancer

You might not think life insurance with kidney cancer is possible, but it is.

Several highly rated carriers offer life insurance for kidney cancer patients. And we’re here to help you shop your best price.

As long as you’re between ages 50 and 85, you cannot be turned down due to your health. Your acceptance is guaranteed.

Are You Looking For Quotes?

Fill out the form on your screen to get started.

You’ll instantly see quotes from top carriers who offer life insurance policies for kidney cancer patients.

Save time and money on your policy.

Get started today.

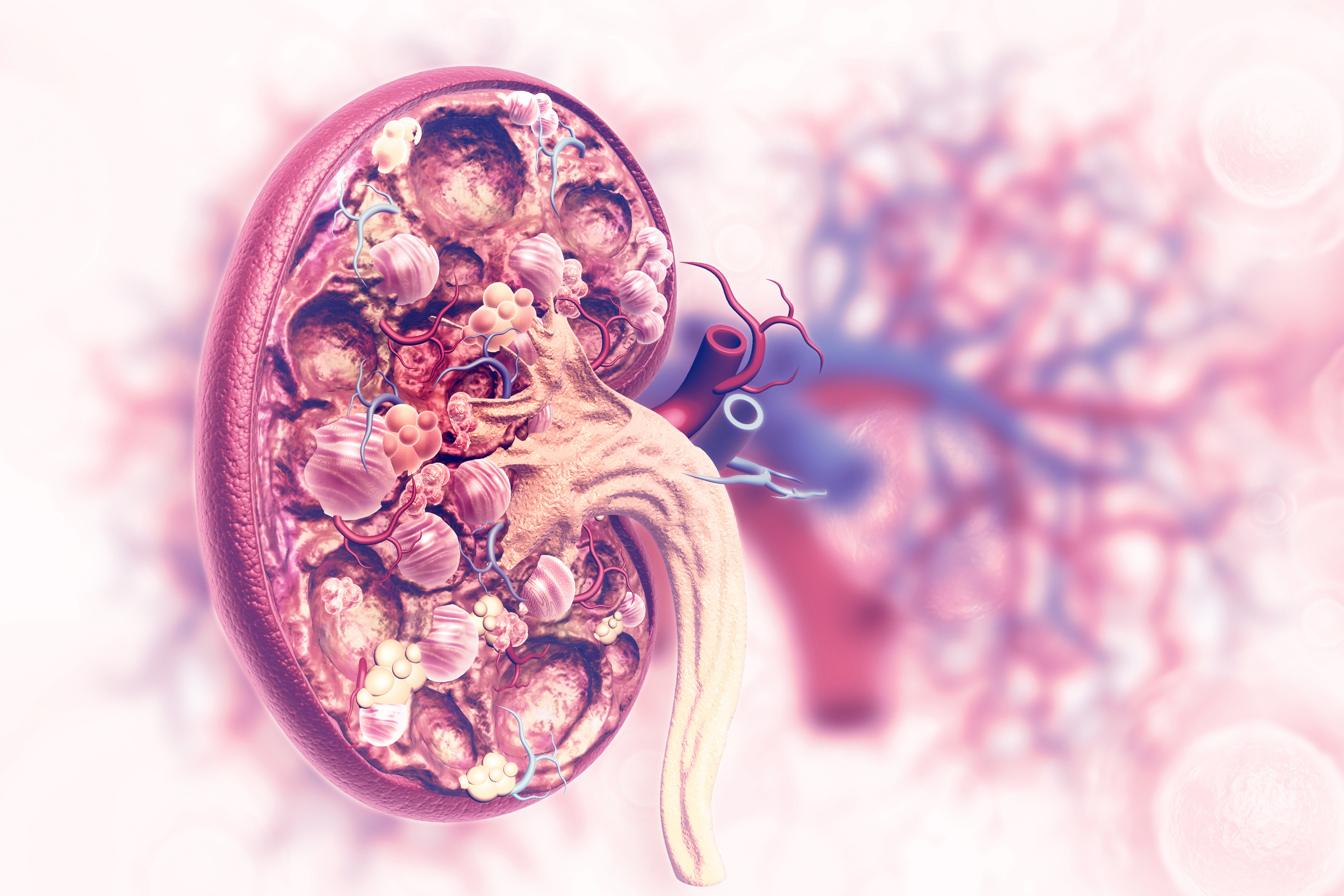

Kidney Cancer & The Need For Life Insurance

Cancer not only threatens your life, but it also can take your last penny along the way.

No one plans to get cancer. Therefore those who do are almost always unprepared to meet the financial challenges that come as a result. For anyone not independently wealthy, you’ll likely need to make financial adjustments to avoid hardship in the future.

The cost of care for cancer patients will vary. However, many cancer treatments cost over $100,00 per year. And even with good health insurance coverage, diagnosed individuals will pay between 10% – 35% out of pocket.

End-of-Life Expenses

When you use your life savings to pay for cancer treatments, its easy to lose sight of the end-of-life expenses that come with death. Funeral costs, unpaid medical bills, and personal debts, if not planned for, can be left behind and cause hardship on your loved ones.

How Life Insurance Can Help

Life insurance provides a financial safety net, not around you, but your surviving loved ones. Policy funds help reduce or eliminate end-of-life costs so that no one has to suffer financially after you’re gone.

Though there’s no telling how the future will unfold, a life insurance policy will bring peace of mind knowing that the funds will be there when needed the most.

Life Insurance Options For Kidney Cancer Patients

Most people seeking life insurance with pre-existing medical conditions know that their life insurance options are limited. However, you still have options.

Guaranteed Acceptance Life Insurance is a type of insurance policy for the elderly and the severely sick. All cancer patients can enroll in guaranteed acceptance regardless of the severity of your condition.

These plans provide up to $30,000 in permanent life insurance coverage for kidney cancer patients. And once enrolled, you lock in your plan and premium rates for life. As long as you pay your monthly premium, your rates will never increase.

Guaranteed acceptance policies are only available for individuals ages 50 to 85, which makes for ideal senior life insurance coverage.

Individuals seeking life insurance with cancer outside this age range will likely not find life insurance coverage.

Being Financially Prepared May Help Extend Your Life

A recent study in the journal of oncology determined that cancer patients who go bankrupt are 80% more likely to die than those who don’t. There is a direct correlation exist between the financial impact a disease has and mortality rates

We’re not saying that life insurance will save you from bankruptcy or extend your life. What we will say is that having a financial plan in place to take care of your final expense can remove some stress and worry about some of life’s financial challenges. Removing fear or worry of any kind is undoubtedly good for your health and recovery.

How to Enroll Today

Enrolling for life insurance with kidney cancer is easier than you might think. Because there are no medical exams or health questions, the application process is super simple.

To begin, fill out the quote form on your screen. You’ll instantly see customized quotes from all the providers operating in your state.

One of our helpful agents will reach out to help compare life insurance companies side by side and discuss policy details.

Once enrolled, your coverage can begin the very next day.

Most states allow up to 30 days a free look period to make sure your policy fits your needs and your budget. We go the extra mile for our clients and work with you through this period. If you need to change, adjust, or return your policy, we’ll gladly take care of it.

Our services are free. And there’s no obligation when speaking with an agent.

See why thousands have chosen us to help them protect what matters most.

Get started today with your free quote.

Call Now To Get Started

253-213-1025

Get a quote from a licensed agent or simply explore your options.

Quotes are free, and there's no obligation.

Request a call from one of our licensed agents.